The convertible corporate bonds (Bond Abbreviation: Wei 22 Convertible Bonds, Code: 113652) issued by Weiming Environment Protection Co., Ltd. with approval from the China Securities Regulatory Commission (CSRC) were successfully listed on the Shanghai Stock Exchange on August 12, 2022. On the first trading day, the bonds surged by 30% to a high of RMB 130, closing at RMB 128.24 with a 28.24% increase, and recorded a trading volume of RMB 64.59 million.

On November 15, 2021, the company’s Sixth Board of Directors’ Ninth Meeting approved the proposal to publicly issue convertible corporate bonds, with a planned total issuance of up to RMB 1.477 billion. In late June 2022, the company received the CSRC’s official approval (Approval No.: [2022]1252), clearing the path for the bond issuance.

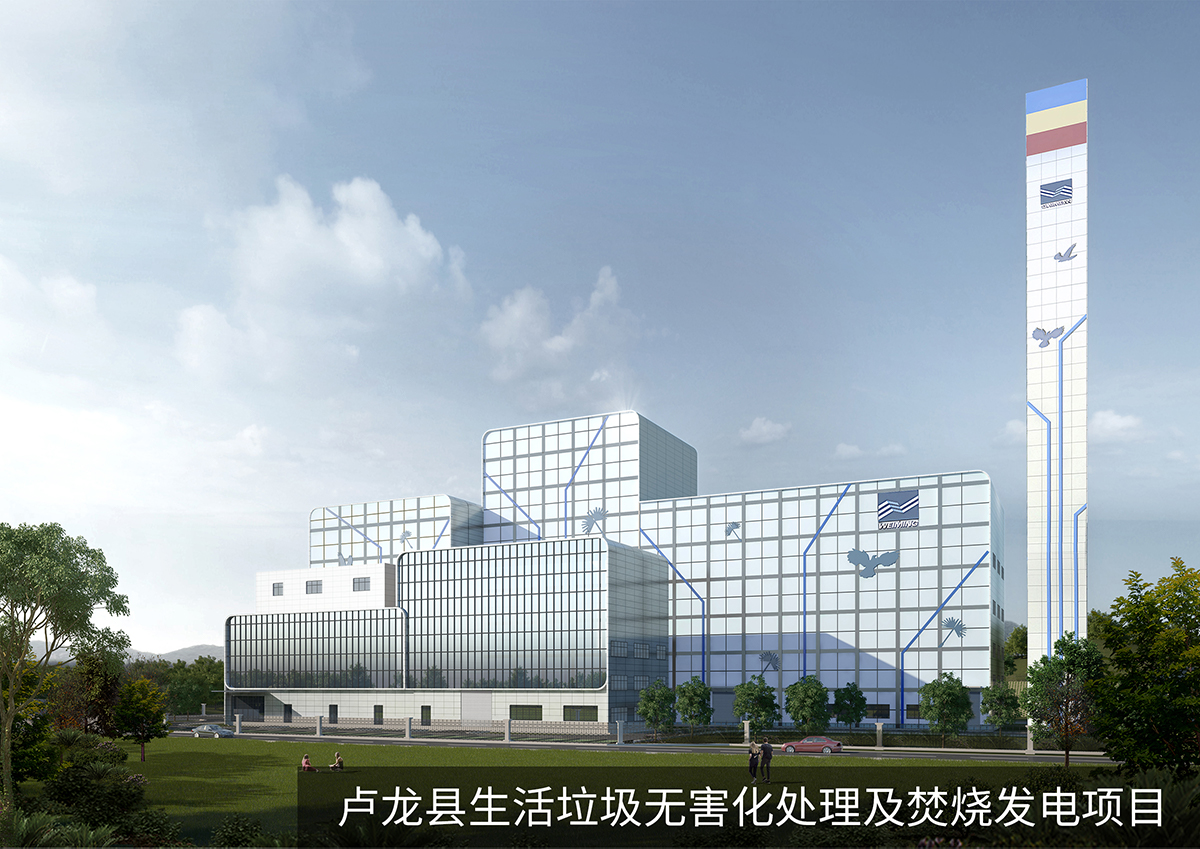

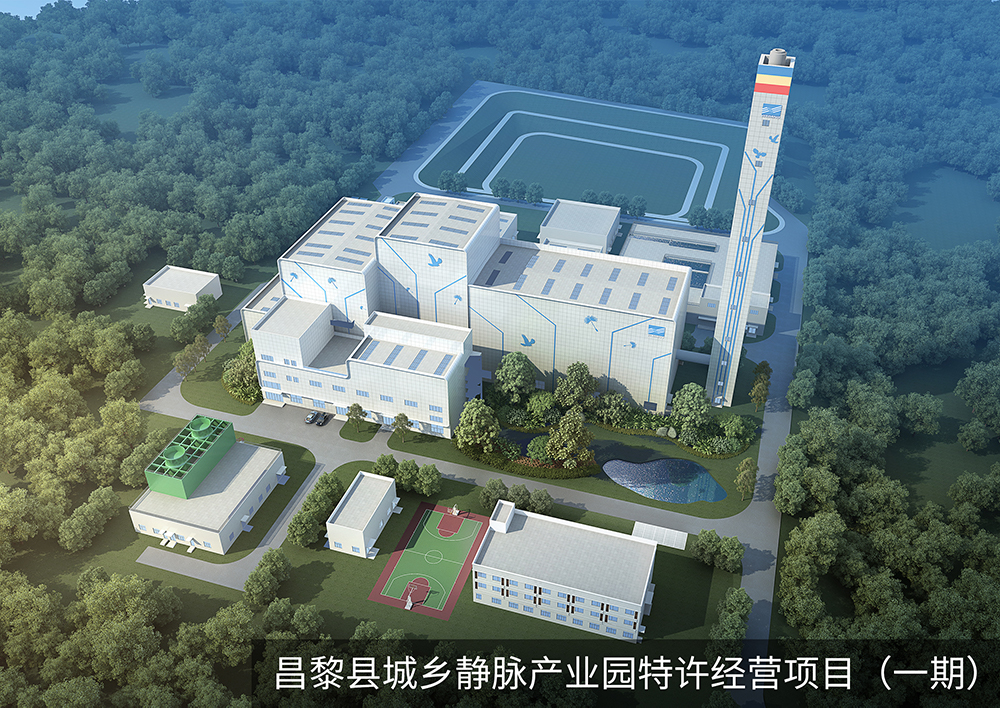

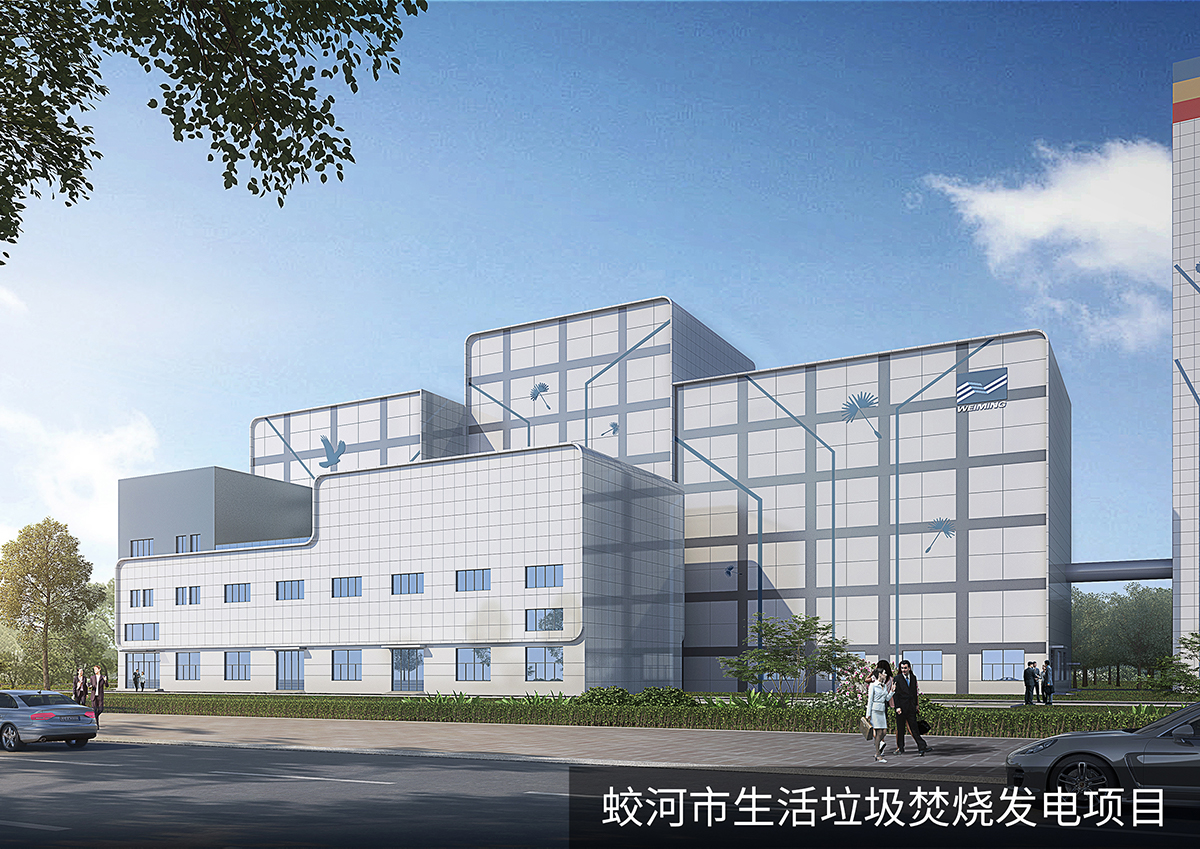

The company's convertible bonds are issued at a face value of RMB 100, with a total issuance amount of RMB 1.477 billion. The bonds have a credit rating of “AA” and a maturity period of six years, with interest paid annually. The principal and final year's interest will be repaid upon maturity. Proceeds will fund projects including the Lulong County Municipal Solid Waste Treatment and Incineration Power Generation Project, Changli County Urban Vein Industrial Park Phase I Franchise Project, Luodian County Waste-to-Energy Power Generation Project, Jiaohe City Waste-to-Energy Power Generation Project, Wuping County Waste-to-Energy Power Generation Project, and working capital supplementation.

Since its IPO in 2015, Weiming has rapidly expanded its core business. As of December 2021, the company’s waste-to-energy projects boast a combined designed capacity of approximately 50,700 tons/day (including projects under Shengyun Environment-Protection, Guoyuan Environmental Protection, joint ventures, and entrusted operations), with 28,400 tons/day in operation or trial operation and 22,300 tons/day under construction or planning. The bond issuance will further strengthen the company’s capital base, laying a solid foundation for stable growth.

This marks the company’s third convertible bond issuance. The “Wei 20 Convertible Bonds” issued in 2020, raising RMB 1.2 billion, were fully delisted in 2021.